Financials

| Listing Price: | $1,875,000 | Building Sq. Ft: | 5,853 | Units | 11 |

|---|---|---|---|---|---|

| Down Payment: | $700,000 | Lot Square Ft: | 46,609 | Price/Unit: | $170,455 |

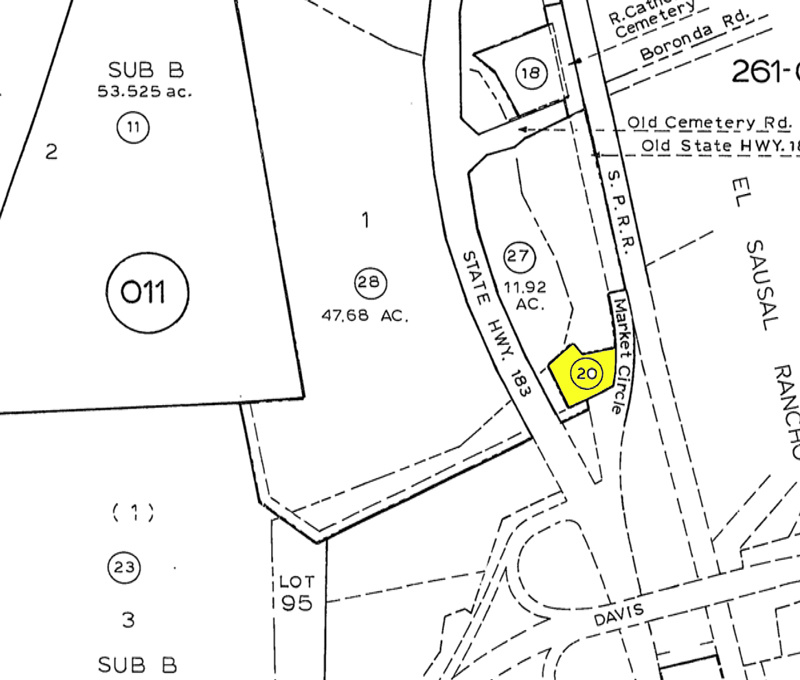

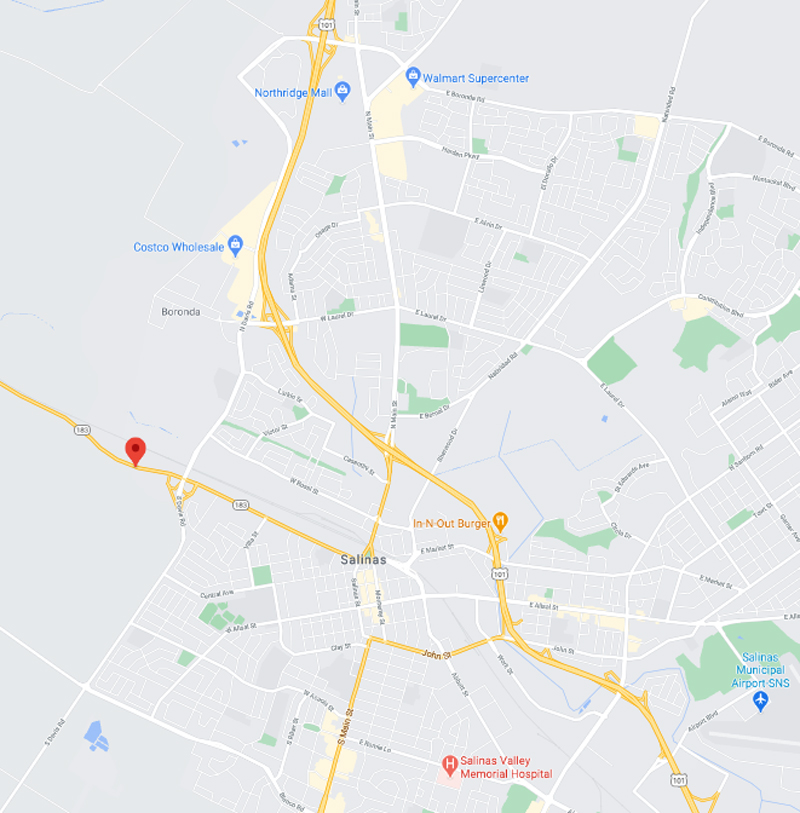

| Loan Amount: | $1,175,000 | APN: | 207-011-020 | Age: | 1914 |

| Current Rent GRM: | 12.76 | Market GRM: | 10.61 | Roof: | Asphalt Comp |

| Cap Rate: | 4.99% | ProForma Cap: | 6.44% | Price/Sq.Ft. | $320 |

| Current: | ProForma: | Monthly Scheduled Rents: | $12,050 | $14,525 | |

| Scheduled Gross Annual Income: | $144,600 | $174,300 | |||

| Less: Vacancy Factor @ 3% | $4,338 | $5,229 | |||

| Effective Gross Income: | $140,262 | $169,071 | |||

| Plus: Laundry Income: | $200 | $2,400 | $2,400 | ||

| Plus: Storage Income: | $300 | $3,600 | $3,600 | ||

| Total Annual Income: | $146,2623 | $175,071 | |||

| Less Expenses: | |||||

| Property Taxes: | 1.08% | $20,856 | 14.26% | $20,856 | 11.91% |

| Direct Assessments: | $373 | $373 | |||

| Repairs and Maintenance: | $650 | $7,150 | 4.89% | $7,150 | 4.08% |

| Off Site Management: | 5% | $7,013 | 4.79% | $8,454 | 4.83% |

| Property Insurance: | $3,000 | 2.05% | $3,000 | 1.71% | |

| Garbage: | $450 | $5,400 | 3.69% | $5,400 | 3.08% |

| Sewer: | $50 | $600 | 0.41% | $600 | 0.34% |

| Water: | $100 | $1,200 | 0.82% | $1,200 | 0.69% |

| PG&E: | $110 | $1,320 | 0.90% | $1,320 | 0.75% |

| Landscaping: | $1,000 | 0.68% | $1000 | 0.57% | |

| Reserves: | $250 | $2,750 | 1.88% | $2,750 | 1.57% |

| Miscellaneous: | $2,000 | 1.37% | $2,000 | 1.14% | |

| Total Expenses: | $4,787 | $52,662 | 36.01% | $54,103 | 30.90% |

| Net Operating Income: | $93,600 | $120,968 | |||

| Annual Debt Service: | 3.75% | $65,903 | $65,903 | ||

| Before Tax Cash Flow: | $27,697 | $55,065 |